accumulated earnings tax irs

The accumulated earnings tax may be imposed on a corporation for a tax year if it is determined that the corporation has attempted to avoid tax to. See State Tax Return Amendment.

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

5471 Schedule O Organization or.

. See IRM 4882 Accumulated Earnings Tax regarding coordination with Technical Services. The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. However only the distributions made from current or accumulated EP will reduce EP.

5471 Schedule M Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons. If the accumulated earnings tax applies interest applies to the tax from the date the corporate return was originally due without extensions. This is the default IRS tax classification for multi-member LLCs.

The LLC must also file a 1065 partnership return as well as provide K-1s to each of the LLCs. The capital fund of a nonprofit organization. An accumulated earnings tax is a tax imposed by the federal government on companies with retained earnings deemed to be unreasonable and in excess of what is considered ordinary.

You do not need to file anything with the IRS in order to make this election. IRC 534b requires that taxpayers be notified if a proposed notice of deficiency includes an amount with respect to the accumulated earnings tax imposed by IRC 531 so that the burden of proof initially will be on a taxpayer. Amend or change an accepted IRS Tax Return by completing a IRS Tax Amendment.

There is no IRS form for reporting the AET. Accumulated Earnings Profits EP of Controlled Foreign Corporation. In the process the IRS accumulated a massive backlog of returns mostly in paper form.

The AAA generally represents the earnings of the S corporation that have been previously taxed but not yet distributed to shareholders. The American Families Plan Accessed Nov. Trends and Proposals for Corporate Tax Revenue Page 1.

Private and publicly held corporations are subject to this tax but it does not impact passive foreign investment companies tax-exempt organizations and personal holding companies. A taxpayer came to me looking for a second opinion on how his companys 2011 and 2012 IRS Form 1120-S were prepared signed and filed because the retained earnings reported on Schedule L was 100000 as in negative AND the Accumulated Adjustment Account AAA on Schedule M-2 was also reported at 100000 as well. S corporations that have accumulated EP are required to maintain an accumulated adjustments account AAA.

Treat an accumulation of 150000 or less as within the reasonable needs of a. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. But the IRS can impose the accumulated earnings tax discussed above if the corporation attempts to avoid dividend taxes for shareholders.

23 In addition to reviewing the Schedule M-2 Analysis of Unappropriated Retained Earnings per Books from a corporations annual Form 1120 a detailed analysis of year-to-year changes in the. A potential problem for S corporations that received PPP loan forgiveness who had accumulated earnings and profits involved the proper classification of the expenses paid with the PPP loan proceeds in the computation of the accumulated adjustments account AAA. Generally the E.

Money is directed into the accumulated fund when revenues are greater than expenditures. To determine if the corporation is subject to this tax first treat an accumulation of 250000 or less generally as within the reasonable needs of most businesses. If imposed the earnings are subject to triple taxation when eventually distributed to the.

This tax can be assessed by the IRS on accumulated retained earnings that have not been earmarked for a clear purpose. A post by Dan Chodan CPA on Twitter on January 3 2022 pointed out that the IRS had now given. Last year was horrendous for millions of taxpayers according to.

These earnings flow through and are taxed at shareholder level when generated and to the extent of basis can be. What Is the Accumulated Earnings Tax. For federal tax purposes the profits and losses of the LLC flow through to the owners individual personal income return Form 1040.

Solved Determine Whether The Following Statements About The Chegg Com

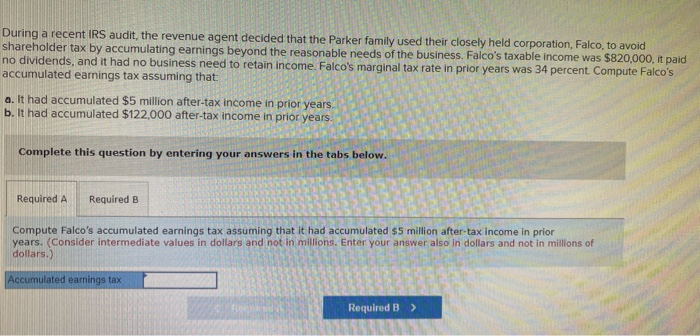

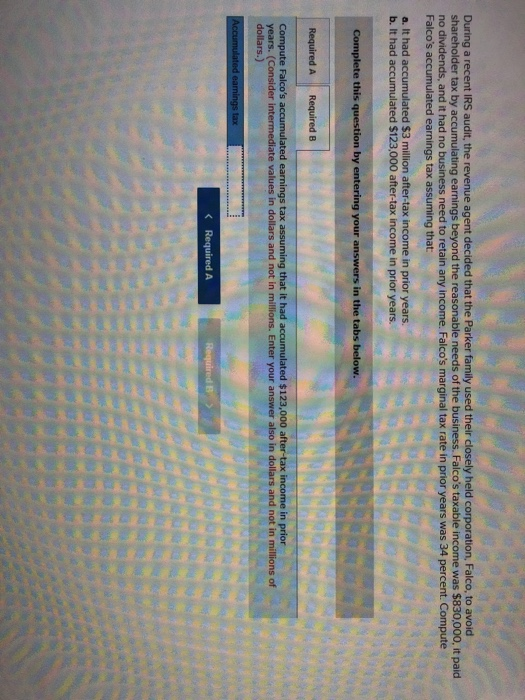

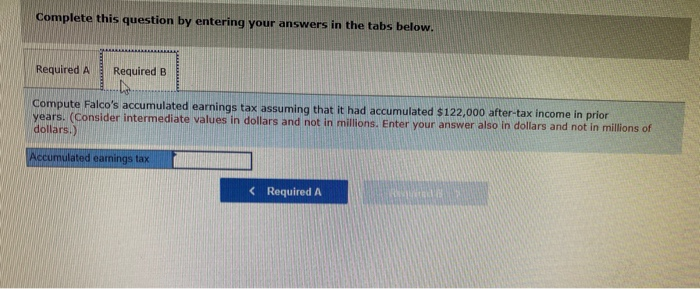

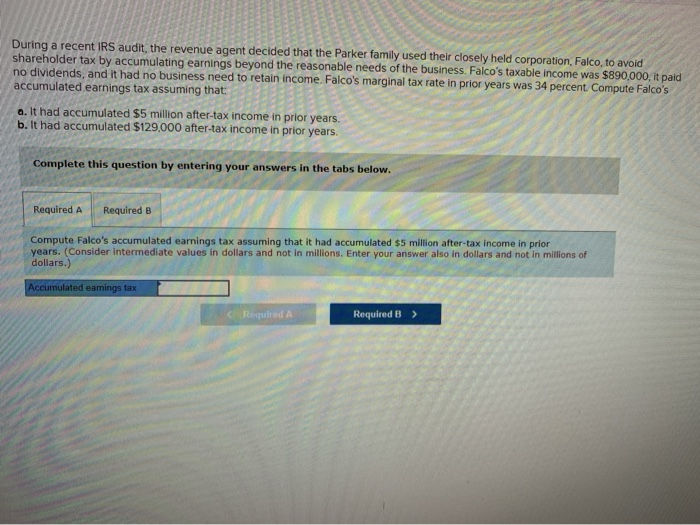

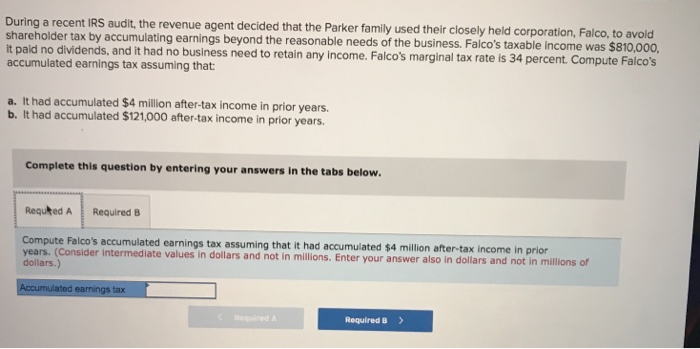

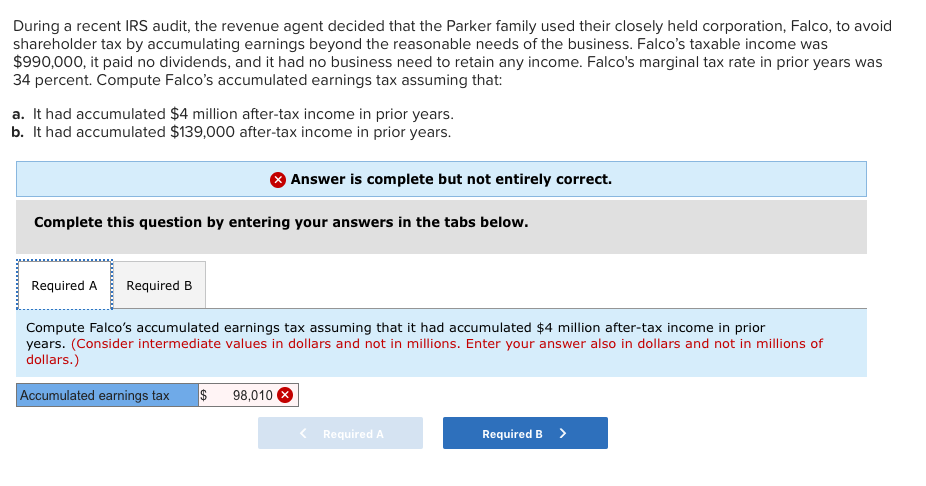

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

Irs Use Of Accumulated Earnings Tax May Increase

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Cares Act Implications On Corporate Earnings And Profits E P

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Earnings And Profits Computation Case Study

Demystifying Irc Section 965 Math The Cpa Journal

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Strategies For Avoiding The Accumulated Earnings Tax Krd

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Accumulated Earnings And Personal Holding Company Taxes C 2008 Cch All Rights Reserved W Peterson Ave Chicago Il Ppt Download

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax